Modern Digital Experiences Built for the

Federal Home Loan Bank System

Partnering with FHLBs to simplify complexity, serve members better, and communicate their model and mission — without compromising governance or security.

We understand the system-level realities, governance requirements, and mission-driven responsibilities that shape what success looks like for each branch.

Complete the form to request a free consult.

Established Expertise

Proven Success Across the FHLB System

Spinutech has partnered with multiple Federal Home Loan Banks to modernize and evolve their digital presence. We understand the shared challenges across the system — and how each branch must tailor solutions to its regional needs.

- FHLB of Des Moines

- FHLB of Des Moines - Mortgage Partnership Finance

- FHLB of Indianapolis

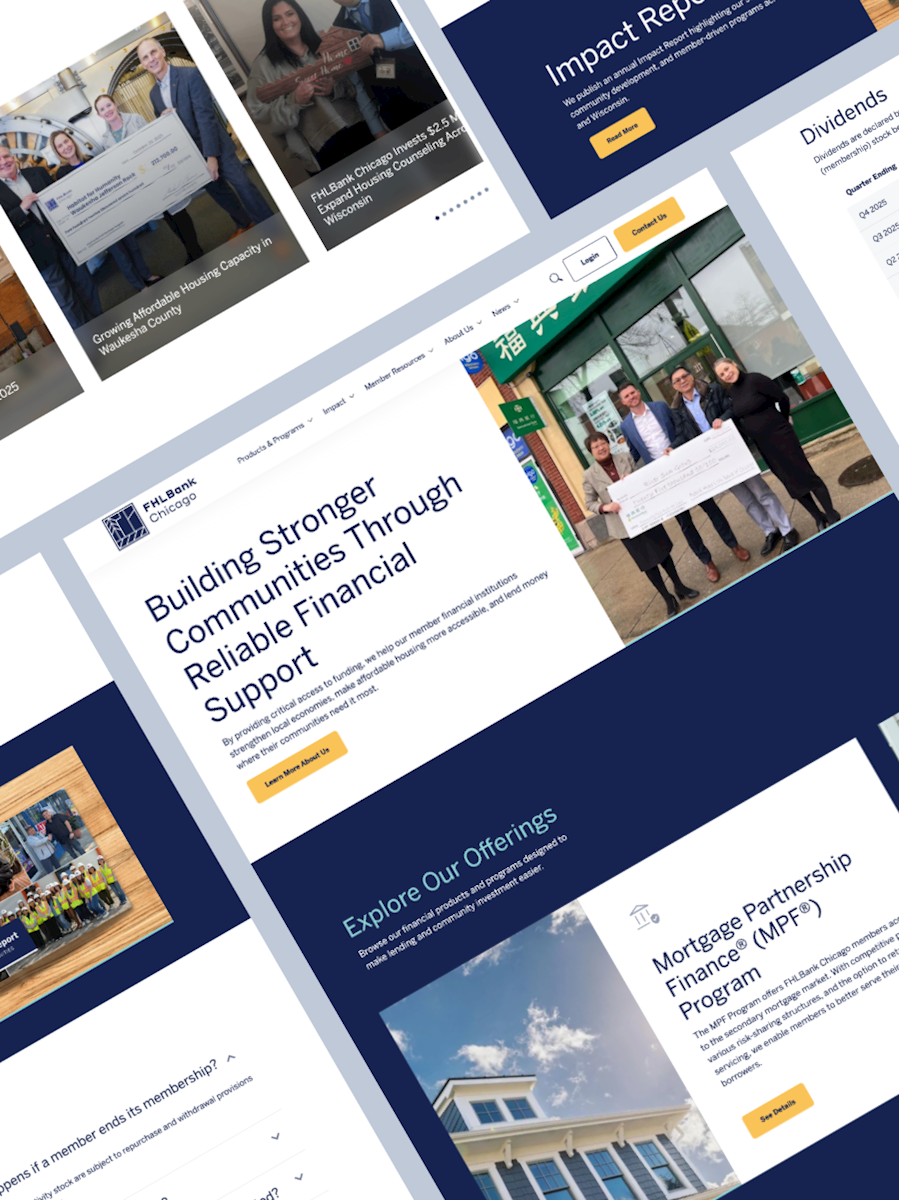

- FHLB of Chicago

- FHLB Mortgage Partnership Finance Program

- Office of Finance (new site nearing launch)

A Custom Approach

We Understand FHLB Challenges

Federal Home Loan Banks operate differently than traditional retail or commercial banks. Their digital environments must support clarity, compliance, and credibility — simultaneously.

Advance programs, housing initiatives, compliance documentation, and member resources grow over time — often creating fragmented navigation, duplicated content, and usability friction.

A single site must effectively serve:

- Member institutions seeking fast, task-oriented access

- Prospective members evaluating eligibility and value

- Regulators, stakeholders, and public audiences seeking transparency

Not everyone understands the "bank of banks" model and cooperative structure. Clear storytelling is essential to demonstrate impact, relevance, and value to housing and communities.

Modernization must operate within:

- Rigorous security scanning and remediation requirements

- Authentication and controlled-access pathways

- Conservative change management processes

Strategy in Action

Our Approach to FHLB Digital Solutions

Spinutech delivers FHLB websites that simplify complexity, improve usability, and communicate mission impact — all within the strict governance framework these institutions require.

A look inside our approach:

We begin with structured discovery — stakeholder interviews, content audits, analytics review — to align priorities around real member needs rather than internal assumptions.

Navigation, pathways, and templates are designed to surface high-demand resources quickly, reducing friction and support burden.

We balance functional utility with mission and impact storytelling through:

Our delivery process accounts for financial-grade constraints, including secure integrations, scanning workflows, and authenticated experiences where appropriate.

Modular design systems and flexible CMS architectures allow branches to grow and adapt over time — without full rebuilds.

A PROVEN PARTNER

Why FHLBs Choose Spinutech

Federal Home Loan Banks operate in one of the most complex digital environments in financial services. They need partners who understand both digital experience and institutional reality.

Spinutech brings:

- Direct, repeatable experience within the FHLB system

- Practical modernization strategies that work inside governance constraints

- Websites that are easier to use, easier to manage, and built to evolve

FREE STRATEGY CONSULT

Let’s Talk About Your Branch’s Digital Priorities

Schedule a short, no-pressure conversation to compare notes on what’s working across the FHLB system — and where your website can better support members, stakeholders, and your mission.

OUR LOCATIONS

Strategically Located To Support Clients Nationwide

Spinutech serves FHLBs across the country, offering personalized services no matter where you're located. Whether you're near one of our offices or further afield, we bring the same level of dedication and expertise to every client we work with.